Divizend

Your personalized digital companion

Your Divizend Companion transforms the whole matter of investing into a unique and especially rewarding walk in the park.

We also mean to cultivate

financial freedom, but in the truest sense.

Outside, as well as within.

And benefit everyone – from private investors

(young and old; beginners and experts) to tax consultants to wealth and asset managers.

Designed to facilitate and encourage dividend strategies

The single most comfortable way to generate a secondary income outside the daily grind. Ask Warren Buffett, for many decades now he has made billions in dividend income on a yearly basis – Divizend’s platform, in a nutshell, empowers your investor mind.

Make use of our Maximizer

Maximize your dividend earnings by reclaiming foreign withholding taxes. Amazingly enough, we’ve automated that process for you.

A few clicks, and you’re all set to get back those excessively paid taxes.

No more reading through tedious websites filled with complex legal jargon that take weeks to decipher!”

Savor our bank-independent Portfolio Import

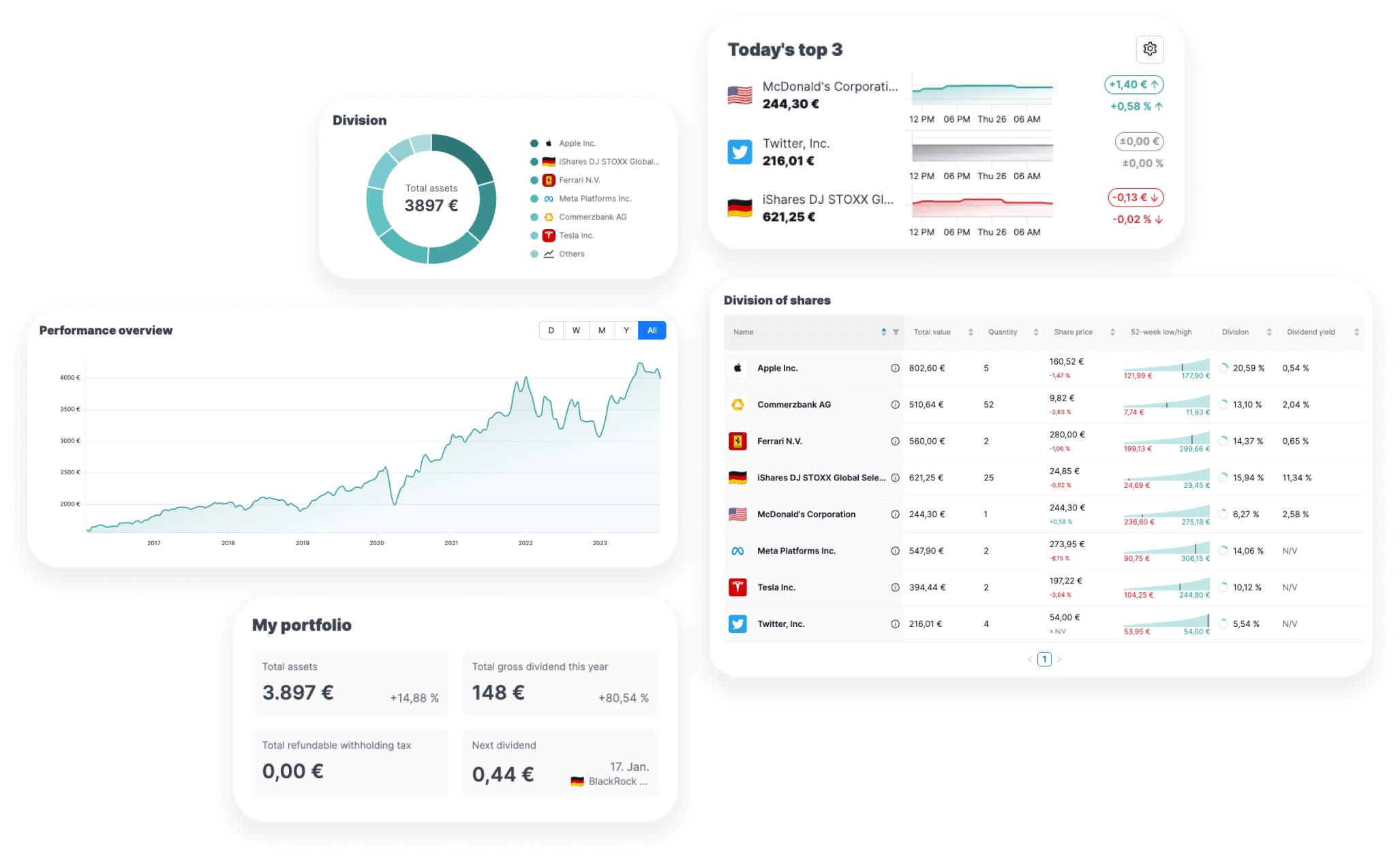

Besides erasing the burden of manually uploading all documents, it renders a dashboard capable of analyzing your (or that of your clients’) entire asset situation.

In one view: Consider the full performance picture all at once, or study your securities individually – In great, great detail: Yield, price per share, 52 weeks low/high, etc.

It really doesn’t matter what bank(s) or brokerage service you’re with; how many portfolios you may own.

With us, any form of aggregation is forever free of charge.

Always and forever: Add and upload onto Divizend. As many portfolios and securities as you like. Our capacity for your ever-evolving wealth is inexhaustible, so to speak.

Register now and get startedOr… since we are already here, enthusiastically flaunting our platform’s skills

A gesture which hopefully won’t get misinterpreted for vanity, just genuine excitement…

On your dashboard

Divizend’s Companion, the gateway to your financial planning

Monitor your upcoming dividend earnings for more than 15,000 international businesses. Featuring detailed records on every securities’ historical performance, with the calendar by your side. No investment decision is a blind ride: It’s a matter of facts.

That is all to say, as by now you might have already guessed it:

We zen your dividends.

Put an end to that unnecessary thinking.

No more questioning.

No more hesitating.

No more stress.

No more anxiety.

Your wise portfolio companion that boils down investing to the essential.

All you have to do now is to take in this clear view and act on it. With the same attentive stillness, you confidently move forward with your plan:

your now actual strategy.

The Divizend Platform

Explore Divizend’s powerhouse in detail